Minnesota’s rural hospitals may be hard hit by ‘big beautiful bill’

Plus: A sweet deal for state’s beet sugar farmers; a salty dispute over taxes; a reader questions Trump’s comments after Minnesota shootings; and more.

WASHINGTON — The U.S. Senate released its version of the ‘big beautiful bill’ that would help implement President Donald Trump’s agenda, and the state’s hospitals — especially those in rural areas — could be among the biggest losers in the legislation.

Last month, U.S. House Republicans approved a massive package of tax and spending cuts projected to result in 7.8 million fewer Medicaid enrollees and is expected to cost Minnesota about $500 million a year in lost Medicaid revenue. The cuts in the House bill would come from the imposition of new work requirements that are expected to reduce enrollment.

The Senate’s version of the budget bill would also impose work requirements but slice even deeper by capping the amount of provider taxes states charge hospitals and doctors to 3.5%. The House bill had set the cap for the provider tax at 6%.

By charging providers a tax and reimbursing them for that money through higher payments for their services, Minnesota and about 40 other states are able to boost the money they receive from the federal government from Medicaid, which is a shared state-federal program.

The proposed cap provoked outcries from groups that represent the nation’s hospitals.

“The Senate just made a bad bill worse,” Chip Kahn, CEO of the Federation of American Hospitals, said in a statement. “Rural communities would take the hardest hit, with struggling hospitals compelled to face difficult decisions about what services to cut.”

Rural areas disproportionately rely on Medicaid, and their hospitals are often the only resort for patients without health coverage.

In Minnesota, the provider tax is currently set at 1.8%, among the smallest of all states. But the state has recently approved a budget that would impose a new Medicaid Directed Payment Program on participating hospitals, effectively raising the provider tax to 5.75% on participating facilities to leverage $1 billion from the federal government to help struggling hospitals.

Mark Jones, executive director of the Minnesota Rural Health Association, said the U.S. Senate budget bill could upend plans for a new directed payment program, which has to be approved by the Centers for Medicare & Medicaid Services (CMS.)

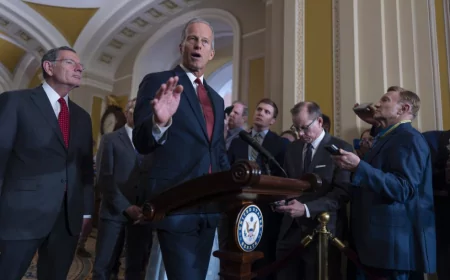

by

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/73776247/1227541383.0.png)